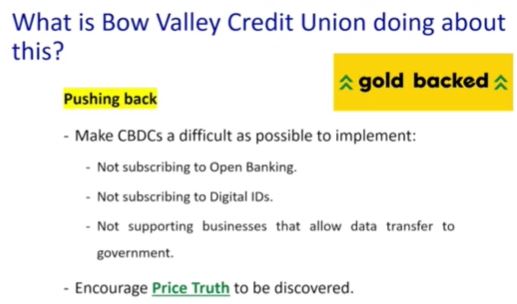

Your financial institution is monitoring personal information about you? What is truly on the horizon with banking in Canada? And how can we stop it?

Brett Oland, CEO of Bow Valley Credit Union, answers these questions and more with his presentation about Fintrac, Digital Currency, and Open Banking. [Brett Oland Interview Feb. 2023 Here]

“Daily direct government access to ALL your financial records should be something all Canadians are concerned about. This type of access to information starts Canada down a path of counties with dictatorships. Similar to the separation of church and state, there should be a separation of government from the commercial business sector.” – Brett Oland

Visit the Bow Valley Credit Union Website

Feb 23/23 Part 1: Truth Talk Interview with Brett Oland of Bow Valley Credit Union in Calgary

Feb 24/23 Part 2: Truth Talk Interview with Brett Oland of Bow Valley Credit Union in Calgary

Arbiter of Financial Truth

- Decades of excessive Money Printing has lead to Malinvestment across western society.

- Price Truth Defined:

Is the uncovering of significant deterioration of the financial and social fabric of western society, because of Money Printing.

. . . ie: The Price Truth about Money Printing and Malinvestment is being exposed through societal/financial deterioration. Hence price is the only arbiter of financial truth.

Financial side effects of Money Printing

Price Truth uncovers the significant deterioration in the financial fabric of western society. It is seen today through:

- Malinvestment

- Lack of price discovery

- Asset bubbles

- Inflation

Societal Side Effects of Money Printing

Price Truth uncovers the significant deterioration in the social fabric of western society. It is seen today through:

- Wealth gap

- Crime

- Class warfare

- Homelessness

- Drug and alcohol abuse

READ THE BOW VALLEY C.U. ‘WHITE PAPER’ MENTIONED IN THE VIDEO… here

March /23: Brett Oland: Benefits of Gold Backed Banking For Protecting Your Wealth

Brett believes that inflation is a massive problem and it will continue for the foreseeable future, resulting in the devaluation of the US dollar. Brett explains currency printing, debt to GDP ratios, and how governments have crossed the debt to GDP Rubicon. Brett also discusses the environmental hysteria surrounding the green revolution, the US sanction list, and the One Belt One Road initiative, as well as the US unfunded liabilities and the worldwide pension crisis.

Tom then asked Brett about the possibility of a European nation, such as Spain, Greece, or Italy, falling as a result of the rise in DXY and commodities. Brett believes the US Federal Reserve will pivot either through quantitative easing or interest rate reductions. Brett suggests that the tool to stabilize the US balance sheet is gold, as it is globally accepted, and the US would need to couple their currency or treasuries to gold to prevent a massive deflationary event.

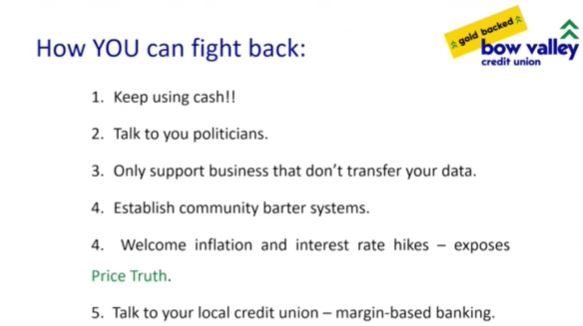

In order to protect Bow Valley Credit Union from the potential economic downturns, Brett has created a strategy to anchor part of their balance sheet with gold. Brett believes this strategy provides an effective way to hedge against tail risks, such as a devaluation event. Brett encourages everyone to talk to their local credit union and push for change in order to protect their finances against inflation.

Time Stamp References:

0:00 – Introduction

0:35 – Background

2:09 – A Gold Initiative

5:26 – The Convoy Protests

9:44 – Fintrac & Policies

13:00 – Presentation

18:08 – Inflation & Devaluation

26:30 – Japan & Yield Control

32:16 – Fed & Treasury

36:13 – Dollar Global Status

38:34 – Importance of Energy

42:27 – U.S. Unfunded Liabilities

49:24 – Three Options

59:16 – Scenarios & Gold

1:01:07 – Gold as Insurance

1:06:24 – Wrap Up

Talking Points From This Episode

– Why gold is an effective tool to stabilize the US balance sheet and hedge against tail risks.

– Credit unions should consider anchoring part of their balance sheet with gold.

– Consider talking with your local Credit Union for changes to protect member wealth.

Brett Oland is the CEO and President of Bow Valley Credit Union, a position he has held for the past 4 years. Before his current role, Brett served on the Board of Directors of Credit Union Central of Alberta for 7 years. He was also on the Board of Directors of Bow Valley Credit Union for 6 years, with 2 of those years serving as Chair.

Brett holds a Bachelor of Commerce from the University of Calgary and is a Chartered Professional Accountant, Canada. He also holds the ICD.D (Institute of Corporate Directors Designation) from Rotman, University of Toronto. With over 20 years of experience in the banking industry, Brett is a highly respected leader in the field.

#Gold #Inflation #DebtToGDP #GDP #GreenEnergy #Sanctions #China #UnfundedLiabilities #Pensions #DXY #Dollar #Commodities #Hedging #Risk #Banking #CreditUnion #Alberta #Canada

.

[…] How To Resist CBDCs – 5 Ways You Can Opt Out Of This Dystopian Future ; ♦ Brett Oland CEO of Bow Valley CU Alberta: Cash, Digital Currency & Open Banking […]