In 2018, Brookfield facilitated a $1.2 billion payout for a 99-year lease on a property owned by Jared Kushner, Trump’s son-in-law, raising questions about indirect connections to Trump’s family business during Kushner’s Middle East envoy role. In Oct. 2022, The US Senate Committee on Finance wrote to Brookfield about: “Brookfield Asset Management’s (“Brookfield”) refusal to provide the Senate Finance Committee (“the Committee”) information it has requested related to a transaction with Kushner Companies involving funding from the Government of Qatar.” In Aug. 2022 Carny became the Chairman of Brookfield Asset Management and Head of Transition Investing. REUTERS 2018 | THE GUARDIAN | More Info |

Carney’s Brookfield role forged multiple connections with Elon Musk. In 2022, Brookfield invested $250 million in Musk’s acquisition of Twitter (now X), marking a significant financial link. FORBES | How Did Elon Fund Twitter? |

That same year, Brookfield backed Musk’s The Boring Company in its Series C funding round, supporting U.S. infrastructure projects. In 2021, Brookfield partnered with Musk’s Tesla to develop an all-solar neighborhood in Austin, Texas, aligning with Carney’s green investment agenda.

Moose on the Loose “SAVE CANADA” Merch & clothing

Original Sources Here

Bill Gates, Mark Carney on Climate Scam

Mark Carney is indeed a member of the World Economic Forum (WEF).

He has served on the Foundation Board of the WEF and has been actively involved in various WEF initiatives, including discussions on climate change, financial stability, and economic policy. His involvement with the WEF spans several roles where he has contributed to panels and task forces, particularly those focused on climate action and sustainable finance. Carney’s association with the WEF is well-documented, highlighting his influence in shaping global economic and environmental policies.

Mark Carney & Brookfield Asset Management

Mark Carney joined Brookfield Asset Management in August 2020, taking on the roles of Vice Chair and Head of ESG (Environmental, Social, and Governance) and Impact Fund Investing. His primary focus at Brookfield has been on developing investment products that aim to combine positive social and environmental outcomes with strong risk-adjusted returns. This includes spearheading efforts in transition investing, particularly in areas like renewable energy and sustainability.

Carney’s appointment came with significant attention due to his previous roles as Governor of the Bank of Canada and the Bank of England, alongside his advocacy for climate action as the United Nations Special Envoy for Climate Action and Finance. His involvement with Brookfield has been seen as aligning with the firm’s commitment to sustainability, especially given Brookfield’s existing track record in renewable investing.

However, Carney’s tenure at Brookfield has not been without controversy. There have been accusations regarding the accuracy of Brookfield’s carbon emissions reporting, with claims that the firm has underreported its emissions significantly, potentially misleading stakeholders about its environmental impact. These allegations surfaced around the time of COP28 in Dubai, where Carney was a prominent figure, highlighting the tension between his public stance on climate action and the corporate practices of the firm he chairs.

Moreover, Carney’s role at Brookfield has intersected with political developments in Canada. He resigned from his positions at Brookfield in January 2025 to run for the leadership of the Liberal Party of Canada, which stirred discussions about potential conflicts of interest, especially considering Brookfield’s business dealings and Carney’s advisory role to the Liberal Party on economic policy. This move was notable as it came at a time when Brookfield was reportedly in discussions for significant financial engagements with Canadian pension funds and government funds, raising questions about influence and transparency in political and corporate spheres.

In summary, Mark Carney’s association with Brookfield has been emblematic of the challenges and complexities at the intersection of high finance, environmental responsibility, and political influence. His leadership in transition investing at Brookfield aimed to steer capital towards sustainable outcomes, yet it also spotlighted debates on corporate environmental accountability and the ethics of political-corporate connections.

Mark Carney & Brookfield buying homes?

Mark Carney, until recently the Chair of Brookfield Asset Management, has been associated with the firm’s strategy of investing in real estate, including single-family homes. Here’s an overview based on available information:

- Recent Moves: Brookfield, through its subsidiaries, has been actively purchasing single-family homes in the United States. In January 2025, a Brookfield private real estate fund acquired a U.S. rent-to-own home platform, Divvy Homes, along with its portfolio of single-family homes for approximately US$1 billion, which includes over 10,000 homes managed by Maymont Homes, a Brookfield company.

- Controversy in Canada: There’s significant public discourse and concern regarding Brookfield’s activities in real estate at a time when Canada is facing a housing crisis. Posts on X have highlighted skepticism about Carney’s potential involvement in addressing housing affordability in Canada, given Brookfield’s acquisition activities. Some users have questioned the ethics of buying up residential properties during a housing shortage, suggesting it could exacerbate the crisis.

- Political and Corporate Overlaps: Mark Carney’s recent transition from Brookfield to running for the leadership of the Liberal Party of Canada has sparked discussions about conflicts of interest, especially in light of Brookfield’s real estate investments. Critics have raised concerns about how Carney can address housing issues when his former company is actively buying up housing stock.

This situation reflects broader debates on corporate real estate investment, housing affordability, and the role of influential figures like Carney in both the private and public sectors. However, the specifics of Brookfield’s strategy under Carney’s leadership, particularly in relation to Canadian housing markets, remain largely speculative based on the available information.

Source: Grok https://x.com/i/grok

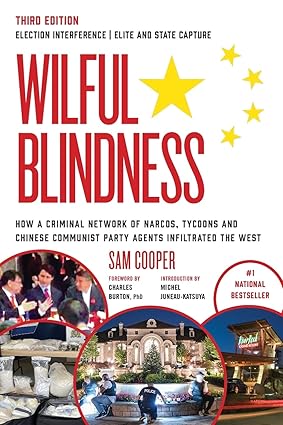

Wilful Blindness: Foreign Interference | Elite and State Capture | How a Criminal Network of Narcos, Tycoons and CCP Agents Infiltrated the West

Paperback – Oct. 22 2024 Click here to purchase from Amazon

Sam Cooper started exposing the CCP’s malfeasances abroad long before “China reporting” was popular. Thanks to his and a few others’ selfless perseverance, Canadians and others worldwide have opened their eyes to the reality of the multiple threats posed by authoritarian China to the freedoms and values we hold dear. Doing so is not without a cost, as Chinese dissidents and diaspora communities around the world know all too well. Sam has and continues to bear that cost, head held high. We owe him and those who worked with him an immense debt of gratitude and a duty to act. Laura Harth, Quote, Campaign Director, Safeguard Defenders, Rome

Wilful Blindness, Foreign Interference, and Elite and State Capture build on the compelling narrative that has cemented Samuel Cooper’s reputation as a premier investigative journalist, now under the banner of The Bureau. Hybrid Warfare does not involve firing a single shot but rather winning the hearts and minds of those in power to influence the decision-making apparatus.

Cooper’s findings now reveal how the Chinese Communist Party used its network and money to influence the outcome of the 2019 and 2021 elections. As the Hogue Commission unfolds, the government continues to block access to key documents that could shed light on a scandal that won’t go away for the Liberal government.

This explosive update makes Wilful Blindness a must-read for anyone seeking to understand the depth of political corruption, elite capture and foreign influence shaping our world today. Cooper also shows readers how China, Iran, and Russia work with organized crime as part of their Transnational Repression Operations worldwide that have targeted diaspora communities from China here in Canada and around the world. However, Canada was the soft underbelly for the PRC to infiltrate and undermine with their eyes clearly on the prize. The USA. In 1982, three of the most influential men in Asia convened in Hong Kong to shape the future of the city’s handover to the People’s Republic of China.

This pivotal meeting saw Chinese business magnates Henry Fok and Li Ka-Shing align with Deng Xiaoping to advance the Chinese Communist Party’s domestic and global ambitions. That day’s decisions would ripple far beyond Hong Kong, reaching as far as Vancouver and reshaping the world. Soon, billions of dollars in Chinese investments poured into North America’s Pacific coast. British Columbia’s government casinos became conduits for global criminals, facilitating the influx of deadly narcotics into Canada and laundering billions of drug money into Vancouver’s real estate market.

This was no accident.

A web of accomplices―revenue-hungry governments, casino and real estate firms with connections to dubious offshore wealth, complicit lawyers and bankers, and an unresponsive RCMP―allowed organized crime to flourish. The consequences of this greed, corruption, and wilful blindness are staggering. Drug cartels, particularly the Big Circle Boys―transnational narco-kingpins with ties to corrupt Chinese officials and industrial tycoons―have infiltrated significant sectors of Canada’s economy. As dirty money inflated Vancouver’s real estate market, the social toll became evident: a fentanyl crisis ravaging North American cities, declining life expectancy in Canada, and an unattainable housing market for the middle class. But the story extends beyond real estate and overdoses.

Samuel Cooper’s investigation reveals that the key players in the “Vancouver Model” of money laundering have turned Canada’s West Coast into a hub for CCP-led corporate and industrial espionage. These unscrupulous entrepreneurs have exported their criminal operations globally, impacting countries like Australia and New Zealand. The 2019 arrest of Cameron Ortis, the RCMP’s top intelligence official, raises alarming questions. Could Chinese transnational criminals and state actors have secured protection from within Canada’s national security apparatus? Could China and Iran possess insights into Canada’s most sensitive secrets and investigations?

Ortis’s oversight of critical probes into transnational money laundering and espionage efforts underscores the depth of the infiltration. Wilful Blindness is a gripping narrative that follows tenacious investigators who challenged the institutionalized negligence and corruption behind the Vancouver Model. Drawing from extensive interviews with whistle-blowers, thousands of pages of government and court documents, and exclusive confidential materials, Cooper uncovers the shocking extent of Canada’s compromise.

The book concludes with a startling revelation about the extent of the infiltration and outlines crucial steps Canada must take to realign with its “Five Eyes” allies and restore national security. In the third edition of his gripping international bestseller, investigative journalist Sam Cooper unveils the explosive narrative of corruption, crime, and complicity that has infiltrated the West. Wilful Blindness dives deep into the murky world of narcos, tycoons, and Chinese Communist Party agents, revealing how they have embedded themselves into the fabric of Western society. Drawing from extensive interviews with whistle-blowers and thousands of pages of government and court documents, Cooper exposes the dark underbelly of political and financial systems.

This book is a testament to Cooper’s relentless pursuit of the truth, from the shocking revelations of money laundering in Vancouver casinos to the high-stakes real estate deals masking illicit activities. The explosive NSICOP report from parliament suggests MPs from the NDP, Liberals and Conservatives have been compromised and may well be committing treason through their Wilful Blindness or direct engagement with PRC agents if only we had laws to prosecute them. Through the pages of Wilful Blindness, he reveals the probable suspects, from backbench MP’s right to the PM’s office. Renowned for his award-winning journalism, Cooper’s work has forced a public conversation about corruption in Canada and beyond.

This edition features new chapters that delve into the continued infiltration by foreign agents and the staggering implications for democracy and national security. Praise for Wilful Blindness is widespread. Dr. Charles Burton calls it “explosive revelations that expose our government’s complicity,” while Terry Glavin highlights its role in sparking a crucial public dialogue. Robert Spalding, a former US Brigadier General, urges readers to understand the modern war landscape through Cooper’s revelations. For anyone seeking to comprehend the complex web of global crime and its insidious impact on Western democracies,

Wilful Blindness is an essential read. This book not only informs but also empowers readers to recognize and confront the pervasive threats to our societal integrity. Updated forewords by Dr. Charles Burton with an Introduction by the former Chief of Asia Pacific, Michel Juneau-Katsuya

Shared from https://www.amazon.ca/Wilful-Blindness-Interference-Criminal-Infiltrated/dp/0888903510

Focus image from Moose on the Loose Youtube page.

How did Elon Musk fund $44B Twitter buyout? Sean Combs pumped in $10M to help Tesla CEO, claims report

Sean ‘Diddy’ Combs’ funding revolves around the strategy of having a ‘seat at the table’, and as a result, he helped Musk with his billion-dollar deal

BY ANNA MATHEW PUBLISHED NOV 5, 2022

SAN FRANCISCO, CALIFORNIA: Elon Musk, the new CEO of Twitter, reportedly had loads of help funding his massive buyout of the microblogging website Twitter. Reports say that even rapper Sean ‘Diddy’ Combs wanted a “seat at this table” and so he is believed to have pumped in $10 million into this deal. Helping the world’s richest man take over the social media platform for a whopping $44 billion were also a host of financial institutions.

The tech mogul’s massive buyout of the social media giant also included other wealthy investors and loans from Wall Street banks that reportedly helped him crack the deal. Some of those investors reportedly include Sequoia Capital, Binance, Qatar Holdings, Twitter co-founder Jack Dorsey and Saudi Arabian Prince Alwaleed bin Talal. Morgan Stanley alone has contributed nearly $3.5 billion to the acquisition, reported CNBC. Canadian investment firm Brookfield has reportedly committed $250 million towards Musk’s Twitter acquisition.

The Hip-Hop legend reportedly invested $10 million into Musk’s takeover. Sources say that Diddy’s investment comes from the fact that he ‘believes’ in Musk’s vision for the microblogging platform, according to TMZ. The rapper who is also known by his stage name Puff Daddy, recently ascended to billionaire status, making him one of the wealthiest artists in the music industry, reported by Forbes, according to Daily Mail.

The music legend and fashion mogul’s 8-figure investment revolves around the strategy of allegedly having a “seat at the table” giving him a reason to help Musk with his billion-dollar deal. It’s reportedly known that the pair hang out in similar circles. Diddy and Musk both attended one of Dave Chappelle’s shows in May and were seen seated in the front row. Kanye West’s Donda 2 experience also noted the rapper and the Tesla owner’s appearance in February. Initially, Musk had planned to limit his investment in the $44 billion Twitter deal to just over $15 billion.

He even planned to sell his stake in electric vehicle maker Tesla Inc to get loans of around $12.5 billion to avoid selling his shares, reported CNBC. However, Musk ditched the idea and later sold around $15.5 billion worth of shares in Tesla in April and August. Sources also reported he is expected to personally pay the transaction a little over $27 billion in cash. The Twitter CEO has already made his presence known in his takeover after he reportedly fired hoards of staff across the globe and reinstated accounts that were previously suspended on the platform.

More Information about Carney as Chairman of Brookfield Asset Management during 2022 Investigated Deal by the U.S. Senate Finance Committee

In 2022, Mark Carney was the Chairman of Brookfield Asset Management and Head of Transition Investing, roles he held from August 2022 until his resignation in January 2025. The $1.2 billion, 99-year lease deal for the 666 Fifth Avenue property owned by Jared Kushner’s family was signed by Brookfield in August 2018, before Carney joined the firm in August 2020. Therefore, Carney had no direct involvement in negotiating or executing the 2018 deal.

However, in 2022, while Carney was chairman, the U.S. Senate Finance Committee, led by Sen. Ron Wyden, investigated the deal due to concerns about potential conflicts of interest involving Jared Kushner and Qatari funding. The committee requested detailed information from Brookfield about the transaction, specifically whether Brookfield was aware of discussions between the Kushner family and Qatari officials and whether Qatari funds were involved through Brookfield Property Partners (BPY), where Qatar’s sovereign wealth fund was a major investor. Brookfield, under Carney’s leadership, declined to provide the requested information, refusing to clarify whether it misled the public about avoiding Qatari-backed funds due to conflict-of-interest concerns. This lack of cooperation drew criticism from the committee.

There is no evidence that Carney personally handled or influenced the response to the Senate inquiry, as such decisions could involve multiple executives or legal teams. His role as chairman would have placed him in a high-level oversight position, but specific actions he took regarding the investigation are not documented in available sources.

The Letter to Private Equity Firm Brookfield Asset Management

Sources:

Wyden Continues Investigation Into Kushner Conflicts of Interest, Influence on U.S. Foreign Policy

CARNEY/TRUMP LOVE-IN LOOKS DIRTY AS HELL

Timeline on Jared Kushner, Qatar, 666 Fifth Avenue, and White House Policy

Published on March 11, 2020

The heart of the case involving President Donald J. Trump and Ukraine was the claim that the president pressured a U.S. ally, weakening the security of that country, to extract a personal benefit for himself. Several commentators have said that the president’s action toward Ukraine fit a pattern of his calling on foreign governments to interfere in US elections. But does it also fit a pattern of trading off the security interests of the United States and foreign partners for personal benefit to himself and his family? We don’t answer that question here. We instead provide a timeline of events surrounding an earlier incident at the Trump White House involving Qatar and the Kushner Companies. We leave it to readers and further investigation to reach any conclusions — whether this was a shakedown of a foreign partner motivated or clouded by personal financial interests or something quite innocent. At a minimum, we believe it raises important questions and concerns that deserve further scrutiny.

When the Kushner Companies purchased 666 Fifth Avenue in midtown Manhattan in early 2007 for a record-breaking price of $1.8 billion, it was supposed to be a center of their real estate portfolio. Instead, the Kushners have struggled to cover their debt on the troubled building since shortly after its purchase on the eve of the financial crisis. As Jared Kushner’s father-in-law, Donald J. Trump, was running for President, the Kushners were pitching Qatari investors to help bail out the building. And just weeks after his father Charles reportedly failed to reach a deal with Qatar’s minister of finance, Jared Kushner, in his capacity as a senior adviser to President Trump, reportedly played a central role in supporting a blockade of Qatar by Saudi Arabia and the United Arab Emirates. Kushner never disclosed his meeting with Saudi Arabia and the UAE on the blockade to Secretary of State Rex Tillerson at the time. Later, a financial company tied to Qatar brokered an especially valuable deal to rescue the Kushner Companies’ property at 666 Fifth Avenue.

The following is a timeline of events related to the Kushners’ pursuit of funding from Qatar for 666 Fifth Avenue and the Trump-Kushner support for the Saudi-UAE blockade of Qatar.

The timeline will be updated as new information becomes available. We invite readers to email us any information we may be missing by sending suggestions to lte@justsecurity.org, whether favorable or unfavorable to President Trump and Jared Kushner. Our goal is to provide an objective, full description of the publicly available record.

Significant credit is due to Mohamad Bazzi who provided a detailed account of several of these activities in an opinion piece for The Guardian in July 2019.

January 2007: Kushner Companies purchases 666 Fifth Avenue for record price on eve of financial crisis

The Kushner Companies purchases, at Jared Kushner’s urging, 666 Fifth Avenue, an office tower in Midtown Manhattan, for $1.8 billion at the height of the real estate market. They invest $500 million, and cover the remaining amount with debt. Even before the financial crisis hits, there are signs that they paid too high a price and took on too much debt for the purchase. It was, at the time, the highest purchase price ever paid for a New York office tower.

2007 – 2008: Global financial crisis and early troubles for 666 Fifth Avenue

As the global financial crisis unfolds, Citigroup announces in December 2007 that it will not renew its lease on about 75,000 square feet of space in 666 Fifth Avenue. In 2008, the Kushners sell a 49 percent stake in the building’s retail space to the Carlyle Group and Crown Acquisitions for $525 million, using part of the proceeds to cover debt on the building.

2010: Kushners’ financial troubles with 666 Fifth Avenue

Kushner Companies’ $1.2 billion loan on 666 Fifth Avenue is transferred to a special servicer to try to restructure the debt after the Kushners reported difficulties in paying the loan. The building is appraised at $820 million, less than half of what the Kushners paid for it in 2007 and less than the debt they owe to banks.

2011

The Kushners sell nearly 50% of the building’s office space to Vornado as part of a refinancing deal on the loan for the building.

2015-2016 and transition to White House: The Kushners negotiate with Qataris

In June 2015, Donald J. Trump formally announces his candidacy for President of the United States.

Throughout 2015 and 2016, Jared and Charles Kushner negotiate with Qatari investor Sheikh Hamad bin Jassim al-Thani (known as “HBJ”) to refinance the building. HBJ is a former Prime Minister of Qatar who manages the country’s $250 billion sovereign wealth fund. One of the meetings Kushner reportedly holds with HBJ is in Trump Tower during the transition in December 2016. He agrees to invest at least $500 million. The deal ultimately falls through when the Kushners fail to raise the rest of the funding from other sources, and the potential investors reportedly worry about public scrutiny from Kushner’s role in the Trump White House.

Tom Barrack told the Washington Post that he tried to use his Qatar connection to help Kushner with 666 Fifth Avenue. “Barrack said he told the former prime minister of Qatar to consider investing in the Kushner Cos. property,” according to the Post. In a subsequent Post story, Barrack says that Kushner’s move to the White House, “just about completely chilled the market, and [potential investors] just said, ‘No way — can’t be associated with any appearances of conflict of interest,’ even though there was none.”

(Note: Barrack says it was the perceived conflict of interest that dissuaded these investors, yet they do, in fact, subsequently invest.)

Note: Steve Bannon’s FBI interview (Feb. 12, 2018):

Bannon reviewed a document Bates stamped SB_00003977 and said the second bullet point was not true. The bullet point said: ‘During transition you had an IT guy do email search of trump servers and discovered Jared met with Anbang and Qataris to raise money for 666 Fifth. You viewed the email that connected the dots. Those meetings left Jared exposed to Comey’” (Steve Bannon FBI 302, p. 166). Anbang Insurance Group has close ties to the Chinese government. (See March 2017 entry below for evidence of Kushner negotiations with Anbang to raise funds for 666 Fifth Avenue.)

Late October, early November 2016: Saudis reach out

A week before the election, candidate Trump meets with Saudi Crown Prince Mohammed bin Salman at Trump’s private residence, according to Rick Gates’ FBI proffer (p. 99).

Kushner is the main point of contact for foreign governments during the campaign.

- According to Gates, “Kushner and Sessions were designated to deal with any requests by foreign officials to the campaign. This decision was made fairly early on as a result of request from Papadopoulos in or around April 2016 about requests from foreign officials. This request was made to Manafort. Manafort and Kushner then made the decision to designate Kushner and Sessions to deal with this.” (Gates FBI proffer, p.99)

- “One of Kushner’s main responsibilities was to have relationships with foreign governments, while Priebus coordinated everyone’ s efforts.” (Gates FBI proffer, p.145)

Post election: Saudi assessment of Trump-Kushner team

Soon after the election, Prince Mohammad Bin Salman sends a delegation of Saudi officials to meet with Kushner and other Trump advisers. They subsequently write an unflattering assessment that later leaks. It says that Trump’s “inner circle is predominantly deal makers who lack familiarity with political customs and deep institutions, and they support Jared Kushner.” The Saudi delegation “brought back a report identifying Mr. Kushner as a crucial focal point in the courtship of the new administration,” according to the New York Times. “He brought to the job scant knowledge about the region, a transactional mind-set and an intense focus on reaching a deal with the Palestinians that met Israel’s demands, the delegation noted.”

January 2017: Jared Kushner officially joins the Trump Administration

Jared Kushner joins the Trump administration as a senior adviser, and formally resigns as chief executive of Kushner Companies. He sells some assets to a family trust, including his stake in 666 Fifth Avenue. However, he retains the vast majority of his interest in the Kushner Companies, and transfers a small portion of his stake in the company to a trust overseen by his mother. He maintains real estate and other holdings worth around $800 million.

From early 2017 onward: Kushner-MBS private communications

Since the early months of the administration, senior officials were worried about Jared Kushner’s having private, informal conversations with Saudi Prince Mohammed bin Salman, a practice he continued even after Chief of Staff John Kelly imposed new protocols, according to the New York Times (December 2018 report). “The private exchanges could make him susceptible to Saudi manipulation, said three former senior American officials,” according to the Times. “There was a risk the Saudis were playing him,” one former White House official said. Intelligence briefers told Kelly that virtually all of the conversations that U.S. officials had with the Saudis on sensitive policy matter had been between Kushner and MBS, according to the Washington Post. “Secretary of State Rex Tillerson and national security adviser H.R. McMaster expressed early concern that Kushner was freelancing U.S. foreign policy. … McMaster was concerned there were no official records kept of what was said on the calls,” the Post reported. McMaster also “learned that Kushner had contacts with foreign officials that he did not coordinate through the National Security Council or officially report,” according to another Post report.

[Note: See entries on December 2017, February 2018, and May 2018 concerning Kushner’s security clearances.]

March 2017: The Kushners negotiate with Chinese financers

After financial talks between the Kushners and the Chinese conglomerate Anbang Insurance Group, which has close ties to the Chinese government, become public, Democratic lawmakers raise concerns to the White House Counsel and Treasury Secretary that a deal could violate federal ethics regulations. Several days later, negotiations end without a deal to finance the building.

April 2017: The Kushners directly approach Qatari government for financing

Charles Kushner and associates meet with Qatari Finance Minister Sharif Al Emadi and aides in New York to seek investment in 666 Fifth Avenue from Qatar’s sovereign wealth fund. No deal is reached.

Following a report by The Intercept on March 2, 2018 on the meeting, a spokeswoman for Kushner Companies, Chris Taylor, denied that such negotiations occured, stating: “To be clear, we did not meet with anyone from the Qatari government to solicit sovereign funds for any of our projects […] To suggest otherwise is inaccurate and false” (Newsweek, March 2, 2018)

Two weeks later, Kushner Companies acknowledged the meeting. Charles Kushner told the Washington Post that he refused the proposal to avoid a conflict of interest for his son.

Note: In his interview with the Washington Post, Charles Kushner also referred to not taking funds directly from Qatar specifically through a sovereign wealth fund. He told the Post: “Before the meeting, Kushner Companies had decided that it was not going to accept sovereign wealth fund investments. We informed the Qatar representatives of our decision and they agreed. Even if they were there ready to wire the money, we would not have taken it.” The Post reports that, on the contrary, according to Tom Barrack, Charles Kushner was “crushed” when the earlier deal with Qatar on 666 Fifth Avenue fell through during the presidential transition.

Charles Kushner later told CNN that he accepted the invitation to the meeting only “out of respect” for the Qataris and to tell them there was no way “we could do business.” He also said taking the meeting was “stupid,” given how it might be perceived publicly. (CNN, April 25, 2018).

Dexter Filkins reported that Charles Kushner’s explanation was false, according to a financial analyst with knowledge of the meeting:

Kushner pitched a huge renovation of the property, which included bringing in retail stores and converting offices to residences, and hosted a follow-up meeting the next day at 666 Fifth Avenue. “He asked for just under a billion dollars,” [the financial analyst] told me. The Qataris declined, citing dubious business logic. “They could have bought the building—believe me, they have the money,” the analyst said. “They just didn’t think it would ever pay off.” The analyst worried that refusing the deal had a political cost. “Here’s a question for you: If they had given Kushner the money, would there have been a blockade? I don’t think so.”

CNN’s Vicky Ward corroborated Filkins’ account citing a person who was in the meeting.

May 20, 2017: Kushner’s “Shadow” Meeting Prior to Blockade of Qatar

President Trump makes his first foreign trip to Saudi Arabia, including in the delegation Secretary of State Rex Tillerson, Jared Kushner, and Steve Bannon. During the trip, Kushner and Bannon meet for a private dinner with top leaders of Saudi Arabia and the United Arab Emirates, who lay out their plan to impose a blockade on Qatar. Secretary Rex Tillerson is neither present for the meeting, nor informed of the meeting. He never learns of the meeting during his time in office (he departed in March 2018). After leaving office, Tillerson testifies before the House Foreign Affairs Committee and says it makes him “angry” to learn of Kushner’s meeting:

Q: A couple of weeks later on May 20th, 2017, you were in Riyadh with the President in advance of the Middle East summit. And you again gave public remarks with the Saudi Foreign Minister. […]

So that same night as we understand it, so on or about May 20th, 2017, there was apparently a private dinner that was hosted between Steve Bannon, Jared Kushner, and the rulers of Saudi Arabia and UAE, respectively. Were you aware of that dinner?

A: No.

[…]

Q: Okay. What’s your reaction to a meeting of that sort having taken place without your knowledge?

A: It makes me angry.

Q: Why is that?

A: Because I didn’t have a say. The State Department’s views were never expressed.– Tillerson Interview Transcript (May 21, 2019), p. 84-85.

A White House spokesperson, Hogan Gidley issues a denial saying, “Jared consistently follows proper protocols” with the National Security Council and State Department, the “alleged ‘dinner’ to supposedly discuss the blockade never happened,” and no one in the White House was “involved in the blockade.”

June 1, 2017: Congressional concerns raised about Kushner’s links to EB-5 visas for Kushner Companies including for 666 Fifth Avenue

On June 1, 2017, Democratic members of the House and Senate Judiciary Committees write to the Kushner Companies, seeking answers on their use of EB-5 foreign investor visas “especially in light of Jared Kushner’s role in the Trump administration and the potential for conflicts of interest” and that the Kushner Companies “may be seeking to benefit from the Kushner family’s connections to the White House.”

June 5, 2017: Blockade of Qatar begins

Saudi Arabia, the UAE, Egypt and Bahrain sever diplomatic and economic relations with Qatar. They accuse Qatar of financing terrorism, supporting Islamist groups, and undermining efforts to isolate Iran. They impose a land, sea, and air blockade on Qatar.

Secretary of State Tillerson and Secretary of Defense Jim Mattis are both caught by surprise by the blockade, according to Tillerson’s testimony before Congress (p. 92). Tillerson and Mattis both publicly call for calm to deescalate the situation. (See also Dexter Filkins’ reporting.)

In a shock to Qatar, Trump initially expresses support for the blockade, in contradiction to the official U.S. government position of neutrality.

Kushner supported the blockade, according to Tillerson’s testimony. “He was more of a view that he thought the blockading countries had, you know, had good reason to do what they were doing,” Tillerson says. Similarly, CNN’s Vicky Ward reports in her book Kushner, Inc.:

Another Tillerson aide told me, “The Saudis would not have risked moving forward without permission from somebody. Now, if you … get a phone call that says, ‘Hey, we’re thinking about doing this,’ you might not have the experience and the capability and the maturity to know how hard to push back. Part of the issue is if you put yourself in as the point of contact and you’re not actually capable of being the point of contact.” This person concluded, “That person must have been Jared.” Until now, Kushner’s dalliances in world affairs had been ethically questionable. With Qatar, Tillerson believed they had become alarming. Threatening Qatar, with the U.S. presence at its air base, was tantamount to threatening the U.S. “Qatar was when [Kushner’s interference] became dangerous for the United States,” said a Tillerson confidant.

Ward also refers to Kushner having “greenlit” the blockade of Qatar, in a piece for The Guardian.

Important note: The Qataris reportedly believe the blockade may be linked to their rejection of funding for 666 Fifth Avenue. “Some top Qatari government officials believe the White House’s position on the blockade may have been a form of retaliation driven by Kushner who was sour about the failed deal, according to multiple people familiar with the matter,” NBC News reported.

See also CNN’s Vicky Ward and author of Kushner, Inc.:

Jun 9, 2017: Tillerson calls for immediate ease on blockade, Trump undercuts him

In a brief, formal statement at the Department of State, Sec. Tillerson calls on the Saudi-led bloc to immediately ease their blockade of Qatar, and less than an hour later Trump undercuts him.

A US official tells the New York Times “that two had spoken immediately before Tillerson’s State Department remarks, which the secretary read over the telephone to the president.”

Sec. Tillerson states:

We call on the Kingdom of Saudi Arabia, the United Arab Emirates, Bahrain and Egypt to ease the blockade against Qatar. There are humanitarian consequences to this blockade. We’re seeing shortages of food. Families are being forcibly separated, and children pulled out of school. We believe these are unintended consequences, especially during this holy month of Ramadan, but they can be addressed immediately. The blockade is also impairing U.S. and other international business activities in the region. … The blockade is hindering U.S. military actions in the region and the campaign against ISIS.

Within an hour, the president says that the Saudi-led action against is “hard but necessary” and claims that Tillerson supports this stance. President Trump states:

The nation of Qatar, unfortunately, has historically been a funder of terrorism at a very high level, and in the wake of that conference, nations came together and spoke to me about confronting Qatar over its behavior. So we had a decision to make: Do we take the easy road, or do we finally take a hard but necessary action? We have to stop the funding of terrorism. I decided, along with Secretary of State Rex Tillerson, our great generals and military people, the time had come to call on Qatar to end its funding — they have to end that funding — and its extremist ideology in terms of funding.

Tillerson reportedly later came to believe concluded that Trump’s White House remarks were written by Yousef al-Otaiba, UAE ambassador to the U.S., and passed to the President by Jared Kushner. “Rex put two-and-two together,” a close associate of Tillerson told the American Conservative, “and concluded that this absolutely vacuous kid was running a second foreign policy out of the White House family quarters. Otaiba weighed in with Jared and Jared weighed in with Trump. What a mess.”

Al-Otaiba and Kushner are known to be friends, having been introduced to each other by Tom Barrack in May 2016. “You will love him and he agrees with our agenda!” Barrack wrote in a May 2016 email to Otaiba. Politico reported in February 2017 that Kushner was “in almost constant phone and email contact with Otaiba.” Otaiba wrote to Barrack in the first months of Trump’s presidency. “I am in constant contact with Jared and that has been extremely helpful.”

August 18, 2017

On Aug. 18, 2017, Steve Bannon leaves the Trump administration.

August 24, 2017

On Aug. 24, 2017, Qatar announces that it is restoring full diplomatic relations with Iran.

October 2017

Bloomberg News reports, “The [666 Fifth Ave.] tower’s cash flow is enough to cover only about half of the debt payments on the building, down from 66 percent last year.”

October 2017: Kushner surprise trip to Saudi Arabia

Kushner and a senior aide travel to Saudi Arabia to meet Prince Mohammed bin Salman. Kushner “flew commercial, and the White House only announced the visit once he was already on the ground,” the Washington Post reports. Some intelligence officials were caught off guard by Kushner’s trip, and “most people in the White House were kept out of the loop about the trip and its purpose … Intelligence officials were troubled by a lack of information about the topics discussed,” according to a later Post report.

November 2017: Kushner Companies receive loan from Qatar-supported company for Chicago property

The Kushners receive a $184 million loan from Apollo Global Management to refinance a building in Chicago. The Qatar Investment Authority is one of Apollo’s largest investors. The loan is triple the average property loan made by Apollo.

The deal with Apollo, along with an additional $325 million loan to the Kushners from Citibank in Spring 2017, concluded after a White House meeting between Kushner and chief executive, Michael L. Corbat, later spark an investigation by the Office of Government Ethics and a review by the White House Counsel.

Peter Mirijanian, a spokesperson for Kushner’s attorney Abbe Lowell, said in a statement that Kushner “has had no role in the Kushner Companies since joining the government and has taken no part of any business, loans, or projects with or for the Companies after that.”

December 2017: Congress raises questions on foreign financing of 666 Fifth Ave.

Several Democratic lawmakers send a letter to Jared Kushner, asking if he has discussed financing for 666 Fifth Avenue with foreign nationals or entities while serving in the administration. The letter states, “We are concerned that you may be leveraging your White House position to seek financial assistance for 666 Fifth Avenue.” They also raise questions about Jared Kushner’s surprise trip to Saudi Arabia in October 2017, when he met with Crown Prince Mohammed bin Salman.

The letter also quotes a Newsweek report connecting the 666 Fifth Avenue situation to Kushner’s security clearance: “Very recently, Newsweek reported: ‘Experts say his stake in the Fifth Avenue building alone is more than enough to cause a suspension of an interim security clearance, as some believe he could use his position in the White House to bail out his family’s investment.’”

January-February 2018: Qatar’s reported intel on Kushner coordination with Saudi bloc

“Qatari government officials visiting the U.S. in late January and early February considered turning over to Mueller what they believe is evidence of efforts by their country’s Persian Gulf neighbors in coordination with Kushner to hurt their country,” NBC reports relying on four sources. Qatar decided not to pursue it out of concern it would undercut their relations with the White House.

February 2018: Kushner loses top security clearance

In mid-February, Kushner’s interim security clearance is reportedly reduced from top secret to secret.

On Feb. 27, 2018, the Washington Post reports that officials in at least four countries – including the UAE and China – have discussed ways to manipulate Jared Kushner, including through his business arrangements, financial difficulties, and inexperience in foreign policy. The Post also reports that in the view of White House officials, “Kushner’s lack of government experience and his business debt were seen from the beginning of his tenure as potential points of leverage that foreign governments could use to influence him.”

March 2018: Tillerson is out; Saudi Crown Prince tours U.S.

Senator Richard Blumenthal calls for an investigation by the Office of Government Ethics into Kushner’s conduct related to the Apollo and Citibank loans.

Rex Tillerson is ousted as Secretary of State. Trump names Mike Pompeo as replacement.

Saudi Crown Prince Mohammed bin Salman conducts a multi-city visit to the United States. On March 20, he meets with President Trump in the Oval Office.

April 2018: Pompeo calls for end of blockade

After President Trump had initially expressed support for the blockade of Qatar, Secretary of State Pompeo tells the Saudis that it is time to end the blockade, almost a year after it began.

May 2018: The Kushners negotiate Qatari financing

Kushner Companies negotiate a bailout deal for 666 Fifth Avenue with Brookfield Asset Management and the Qatari sovereign wealth fund.

May 2018: Trump restores Kushner’s top-secret clearance

President Trump orders his chief of staff, John Kelly, to restore Kushner’s top-secret security clearance, which had been stripped in February. The president’s order is over the objections of U.S. intelligence and White House officials. Both Chief of Staff Kelly and White House Counsel McGahn write contemporaneous notes memorializing their concerns. Trump’s involvement in the process contradicts the president’s denial of any such role to the New York Times as well as public denials by Ivanka Trump and Kushner’s lawyer, Abbe D. Lowell. Commentators observe subtle changes in Lowell’s denial of the allegations over time (here and here).

June 21, 2018: Kushner flies to Qatar to hold intergovernmental meetings

An official U.S. readout of the trip is here.

August 1-3, 2018: The Kushners receive bailout on 666 Fifth Avenue from Qatar-supported company (plus Westinghouse deal)

On Aug. 3, the Kushners reach a deal to bailout 666 Fifth Avenue through a 99-year lease to Brookfield Asset Management for about $1.1 billion in rent for the entire 99-year term paid upfront, easing their financial troubles by allowing them to pay off most of what they owe lenders on the building. The Qatar Investment Authority is the second-largest investor in Brookfield.

Qatar Investment Authority later insists that it had “absolutely no involvement in the 666 Fifth Avenue development.”

- “Both Brookfield and the Qatar Investment Authority, the sovereign fund of the oil-rich Middle Eastern emirate, said the Investment Authority had no knowledge of the deal. A spokesman for the Investment Authority said the fund ‘has no involvement whatsoever in this deal.’” (NYTimes, May 17, 2018)

- “Brookfield has said that the Qataris had no knowledge of the deal before its public announcement.” (NYTimes, Aug 3, 2018)

Two days earlier, on Aug. 1, Brookfield closed a deal to acquire 100% of Westinghouse Electric Company. In Feb. 2019, the House Committee on Oversight and Reform releases an interim staff report, based on whistleblower revelations, raising grave concerns over the Trump Administration’s efforts to transfer sensitive nuclear technology to Saudi Arabia without congressional review. The report notes that Westinghouse, which builds nuclear reactors, stands to benefit greatly from such a deal, and that Jared Kushner has been centrally involved. A July 2019, second interim staff report states that:

- “[W]ith regard to Saudi Arabia, the Trump Administration has virtually obliterated the lines normally separating government policymaking from corporate and foreign interests. The documents show the Administration’s willingness to let private parties with close ties to the President wield outsized influence over U.S. policy towards Saudi Arabia. These new documents raise serious questions about whether the White House is willing to place the potential profits of the President’s friends above the national security of the American people and the universal objective of preventing the spread of nuclear weapons.”

November 2018

In order to finance its over $1 billion deal on 666 Fifth Avenue, Brookfield receives a $300 million-plus mezzanine loan from Apollo Global Management, a private equity company with ties to Qatar that had previously loaned $184 million to the Kushners in November 2017.

January 2019

Sparked by reports that the White House overruled career officials in order to restore Jared Kushner’s security clearance, the House Committee on Oversight and Reform launches an investigation into the White House security clearance process. In an interview with Committee staff in March, 2019, White House employee Tricia Newbold, who came forward as a whistleblower, described a “Senior White House Official 1” – reportedly Jared Kushner – as having “significant disqualifying factors,” for a security clearance, “including foreign influence, outside activities (‘employment outside or businesses external to what your position at the EOP entails’), and personal conduct.” She testified that this determination by her and the first-line was overruled by Carl Kline, Director of the Personnel Division, without Kline addressing all the disqualifying concerns or recording his reasons in the file. In testimony to the Committee in May, 2019, Kline denied being pressured to grant Kushner’s clearance. White House officials Crede Bailey and Cory Louie also later testified that they did not feel pressured to grant the clearances. Newbold also reported that another agency later had “serious concerns” after Kushner applied for a higher level of clearance.

February 2019

The Kushner Companies’ original $1.4 billion in loan payments for 666 Fifth Avenue is due.

Reuters reports that the 666 Fifth Avenue deal in August 2018, in which Qatar “unwittingly” played a role as an investor in Brookfield, has prompted Qatar to rethink its investment strategy.

March 2019

Axios reports that House Democrats are considering an investigation into the Kushner’s August 2018 deal with Brookfield that bailed out 666 Fifth Avenue.

Shared from https://www.justsecurity.org/69094/timeline-on-jared-kushner-qatar-666-fifth-avenue-and-white-house-policy/

.