First West Credit Union signs the UN Principles for Responsible Banking

LANGLEY, B.C. – As a continuation of its firm commitment to responsible environmental, social and governance practices, First West Credit Union and its divisions Envision Financial, Valley First, Island Savings and Enderby & District Financial have become an official Signatory of the UN Principles for Responsible Banking (UN PRB) – a single framework for a sustainable banking industry developed through a partnership between banks worldwide and the United Nations Environment Programme Finance Initiative (UNEP FI).

The UN PRB consists of six principles that align with the vision society has set out for its future through the UN Sustainable Development Goals and the Paris Climate Agreement. Financial institutions who have signed the Principles commit to be ambitious in their sustainability strategies, working to embed sustainability into the heart of their business, while allowing them to remain at the forefront of sustainable finance.

“When you consider our co-operative values— the same values that have always guided our decisions— signing onto the UN PBR was perfectly aligned with our mission of helping our members and communities thrive,” says Launi Skinner, CEO at First West Credit Union. “The time for action is now and we are proud to be joining a global banking community that is focused on sustainable finance to ensure we use our business as a force for good, now and into the future.”

Under the Principles, signatory banks measure the environmental and social impact resulting from their business activities, set and implement targets where they have the most significant impact, and regularly report publicly on their progress. The Principles provide a framework for financial institutions to understand the risks and seize the opportunities arising from the transition to more sustainable economies.

Signatories to the Principles take on a leadership role, demonstrating how banking products, services and relationships can support and accelerate the changes necessary to achieve shared prosperity for both current and future generations, building a positive future for both people and planet.

First West is the third credit union in Canada to sign the UN PBR. This announcement comes in the wake of First West releasing its second annual ESG Rating through Morningstar Sustainalytics earlier this month. For more information on the Principles for Responsible Banking: www.unepfi.org/responsiblebanking

Dec. 29, 2022 Shared from

https://www.firstwestcu.ca/media/fwcu/first-west-credit-union-signs-the-un-principles-for-responsible-banking/

First West aims to create positive change for members, communities, and planet with improved ESG rating

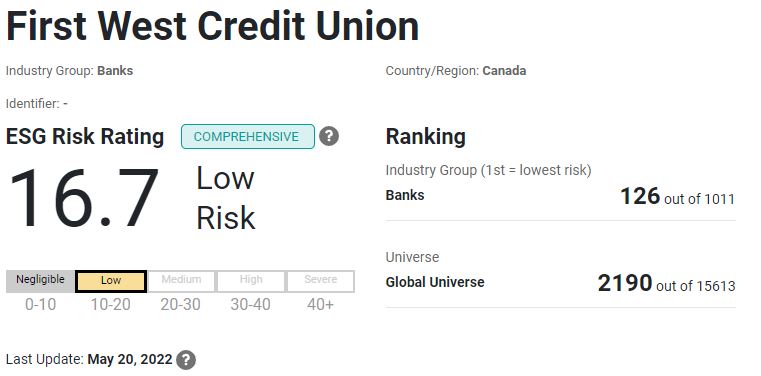

LANGLEY, B.C. –First West Credit Union has continued its journey to becoming a more sustainable and socially conscious organization by engaging Morningstar Sustainalytics, a leading global provider of Environmental, Social, and Governance (ESG) research, ratings, and data , for a second consecutive year to obtain a formal ESG risk rating.

Understanding more about ESG

“Being a financial co-operative means our members have chosen to align themselves with us because we have a shared interest of making our world and communities a better place,” says Launi Skinner, CEO of First West Credit Union. “Although this has always been our mission and always will be, receiving a formal ESG rating helps us confirm our organization is having the intended impact and helps us identify where we can improve.”

This second annual rating placed First West in the upper echelon of global financial institutions with a rating of 16.7 “low,” indicating the organization’s low exposure to ESG risks and that they are managing their environment, social, and governance risks well. This is an improvement over last year’s rating of 18.6 “low”.

Some areas that helped form First West’s strong ESG rating included their community investment programs, providing responsible investment options to members, having a strong commitment to equity, inclusion and diversity and ensuring members’ information is safe and secure.

“Although the elements that go into forming this rating are incredibly complex, the crux actually remains quite simple—enabling us to use our business as a force for good, now and into the future,” says Skinner. “Ultimately, we believe it’s incredibly important to walk the walk when it comes to ESG and be transparent and accountable in the work that is being done.”

For more information on this rating, visit: https://www.sustainalytics.com/esg-rating/first-west-credit-union/2003363290

UN – Principles For Responsible Banking

Creating the future of banking

The Principles for Responsible Banking are a unique framework for ensuring that signatory banks’ strategy and practice align with the vision society has set out for its future in the Sustainable Development Goals and the Paris Climate Agreement.

The framework consists of 6 Principles designed to bring purpose, vision and ambition to sustainable finance. They were created in 2019 through a partnership between founding banks and the United Nations. Signatory banks commit to embedding these 6 principles across all business areas, at the strategic, portfolio and transactional levels.

A 3-step process guides signatories through implementing their commitment:

- Impact Analysis: identifying the most significant impacts of products and services on the societies, economies and environments that the bank operates in.

- Target Setting: setting and achieving measurable targets in a banks’ areas of most significant impact.

- Reporting: publicly report on progress on implementing the Principles, being transparent about impacts and contributions.

Through the Principles, banks are convened by the United Nations to collectively produce cutting-edge guidance and pioneering tools on key areas of sustainable finance, learn best-practice from their peers, scientists and industry experts, and benefit from individual feedback and collective reviews as they progress on their sustainability journey.

To learn more

To view “Who has created these Principles” scroll to the bottom of the flyer. To see their partnership status with the WEF visit this page Vote With Your Money: No WEF Partner Businesses

The United Nations -World Economic Forum Strategic Partnership Framework for the 2030 Agenda

New York, USA, 13 June 2019 – The World Economic Forum and the United Nations signed today a Strategic Partnership Framework outlining areas of cooperation to deepen institutional engagement and jointly accelerate the implementation of the 2030 Agenda for Sustainable Development. The framework was drafted based on a mapping of existing collaboration between the two institutions and will enable a more strategic and coordinated approach towards delivering impact.

The UN-Forum Partnership was signed in a meeting held at United Nations headquarters between UN Secretary-General António Guterres and World Economic Founder and Executive Chairman Klaus Schwab.

“Meeting the Sustainable Development Goals is essential for the future of humanity. The World Economic Forum is committed to supporting this effort, and working with the United Nations to build a more prosperous and equitable future,” said Klaus Schwab, World Economic Founder and Executive Chairman.

“The new Strategic Partnership Framework between the United Nations and the World Economic Forum has great potential to advance our efforts on key global challenges and opportunities, from climate change, health and education to gender equality, digital cooperation and financing for sustainable development. Rooted in UN norms and values, the Framework underscores the invaluable role of the private sector in this work – and points the way toward action to generate shared prosperity on a healthy planet while leaving no one behind,” said António

The EDISON Alliance – Shared Principles for an Inclusive Financial System

About Sustainalytics

1. Sustainalytics utilizes wealth data provided by the World Bank and groups a country’s assets (or National Wealth) into three categories:

Natural & Produced Capital

e.g. infrastructure, energy independence and natural resources

Human Capital

e.g. access to water and sanitation, mean years of schooling and life expectancy

Institutional Capital

e.g. rule of law, corruption and political liberties

2. A country’s ability to utilize and manage its wealth in an effective and sustainable manner is determined by:

ESG Performance

ESG Trends

ESG Events

e.g. civil conflicts, natural disasters

Who is Michael Jantzi, the CEO in the above document?

He has moved on. He is now a member of the ISSB

Michael Jantzi was appointed as a full-time member of the International Sustainability Standards Board (ISSB) in June 2022, effective 16 July 2022.

He has 30 years’ experience in responsible investment and sustainable finance. He joined the ISSB from Morningstar, where he served as Managing Director of ESG Strategy. He is the founder and former CEO of Sustainalytics, an ESG research and ratings firm that grew to global market prominence under Michael’s leadership and was subsequently acquired by Morningstar in 2020.

In 1992, he founded Jantzi Research and led a multiple-company merger that formed Sustainalytics in 2009.

He has served on the Board of Directors of the Value Reporting Foundation and of the Principles for Responsible Investment. He has also served as a committee member of the Independent Review Committee on Standard Setting in Canada and as a board director of the MakeWay Foundation.

Mr Jantzi holds a Master of international relations from Dalhousie University in Halifax, Canada

The Paris Climate Agreement

The Paris Agreement is a legally binding international treaty on climate change. It was adopted by 196 Parties at COP 21 in Paris, on 12 December 2015 and entered into force on 4 November 2016.

Its goal is to limit global warming to well below 2, preferably to 1.5 degrees Celsius, compared to pre-industrial levels.

To achieve this long-term temperature goal, countries aim to reach global peaking of greenhouse gas emissions as soon as possible to achieve a climate neutral world by mid-century.

The Paris Agreement is a landmark in the multilateral climate change process because, for the first time, a binding agreement brings all nations into a common cause to undertake ambitious efforts to combat climate change and adapt to its effects.

How does the Paris Agreement work?

Implementation of the Paris Agreement requires economic and social transformation, based on the best available science. The Paris Agreement works on a 5- year cycle of increasingly ambitious climate action carried out by countries. By 2020, countries submit their plans for climate action known as nationally determined contributions (NDCs).

NDCs

In their NDCs, countries communicate actions they will take to reduce their Greenhouse Gas emissions in order to reach the goals of the Paris Agreement. Countries also communicate in the NDCs actions they will take to build resilience to adapt to the impacts of rising temperatures.

Long-Term Strategies

To better frame the efforts towards the long-term goal, the Paris Agreement invites countries to formulate and submit by 2020 long-term low greenhouse gas emission development strategies (LT-LEDS).

LT-LEDS provide the long-term horizon to the NDCs. Unlike NDCs, they are not mandatory. Nevertheless, they place the NDCs into the context of countries’ long-term planning and development priorities, providing a vision and direction for future development.

How are countries supporting one another?

The Paris Agreement provides a framework for financial, technical and capacity building support to those countries who need it.

Finance

The Paris Agreement reaffirms that developed countries should take the lead in providing financial assistance to countries that are less endowed and more vulnerable, while for the first time also encouraging voluntary contributions by other Parties. Climate finance is needed for mitigation, because large-scale investments are required to significantly reduce emissions. Climate finance is equally important for adaptation, as significant financial resources are needed to adapt to the adverse effects and reduce the impacts of a changing climate.

Technology

The Paris Agreement speaks of the vision of fully realizing technology development and transfer for both improving resilience to climate change and reducing GHG emissions. It establishes a technology framework to provide overarching guidance to the well-functioning Technology Mechanism. The mechanism is accelerating technology development and transfer through it’s policy and implementation arms.

Capacity-Building

Not all developing countries have sufficient capacities to deal with many of the challenges brought by climate change. As a result, the Paris Agreement places great emphasis on climate-related capacity-building for developing countries and requests all developed countries to enhance support for capacity-building actions in developing countries.

How are we tracking progress?

With the Paris Agreement, countries established an enhanced transparency framework (ETF). Under ETF, starting in 2024, countries will report transparently on actions taken and progress in climate change mitigation, adaptation measures and support provided or received. It also provides for international procedures for the review of the submitted reports.

The information gathered through the ETF will feed into the Global stocktake which will assess the collective progress towards the long-term climate goals.

This will lead to recommendations for countries to set more ambitious plans in the next round.

What have we achieved so far?

Although climate change action needs to be massively increased to achieve the goals of the Paris Agreement, the years since its entry into force have already sparked low-carbon solutions and new markets. More and more countries, regions, cities and companies are establishing carbon neutrality targets. Zero-carbon solutions are becoming competitive across economic sectors representing 25% of emissions. This trend is most noticeable in the power and transport sectors and has created many new business opportunities for early movers.

By 2030, zero-carbon solutions could be competitive in sectors representing over 70% of global emissions.

shared from https://unfccc.int/process-and-meetings/the-paris-agreement/the-paris-agreement

[People Need To Remove Their Country From Any & All UN/WEF/WHO Agreements]

Do not be fooled by the Co2 / Global Warming / Climate Change lies.

Bloomberg & Forbes are WEF partnered companies.

https://www.weforum.org/organizations/forbes

https://www.weforum.org/organizations/bloomberg-lp

A good watch

Be sure you take time to watch the documentary called UNsustainable. Find out what the total agenda is, what UNDRIP is. We, YOU are next.

https://peoplesworldwar.com/undrip-the-un-captures-vancouver-bc-your-land-next/

Updates on the way.

.

[…] What is UNEPFI Agreement [Principles For Responsible Banking] […]